Enable Province-Specific Settings

Canadian users designate their province and configure province-specific settings when starting their application trial. The region-specific accounting rules will automatically apply and can be disabled.

Selecting Your Province

To select your province:

- From the toolbar, click your Profile icon.

- From the drop-down, select Setup.

- From atop the Setup left navigation, click Firm Settings.

- From the tabs atop the Firm Settings screen, click Regional.

- Under Regional Settings, check the box to Enable Canada specific account rules.

The Enable Canada Specific Settings message box displays. - From the Province drop-down, click your province.

Note: If a province is already listed, but is incorrect, click the edit pencil icon to the right of the field to change it. - Click Apply Province Specific Settings.

The Settings Applied message box displays the settings applied based on your province selection. You can also access this information via the orange details icon to the right of the edit pencil. - Click OK.

The system updates, returning you to the Financial tab.

As mentioned, this setting affects account tax calculations as well as other defaults. For that reason, once set up, we do not recommend changing this setting going forward.

Province Specific Defaults

Below your selected province, province-specific settings and features might display.

| Alberta |

|

|---|---|

| Ontario, Newfoundland & Labrador |

|

| British Columbia |

|

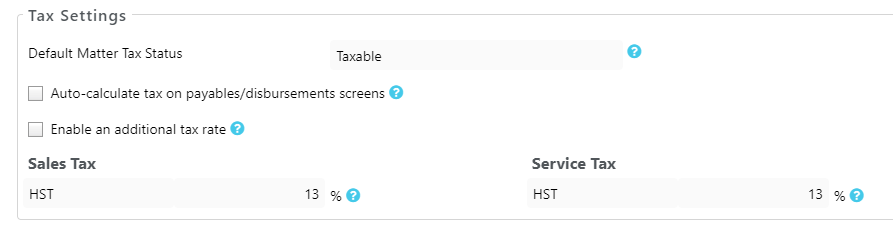

Tax Setting Summary

Once you have finalized your provincial settings, the Financial tab’s Tax Settings section will display the applicable tax type and current taxable rates.

The example applies to Ontario:

Note: If you select a province that tracks two types of taxes, both will display here.

Invoice Customization

You can edit templates to show your Tax IDs on your invoices.

If you are not in an HST province, you must customize the invoice template to include an additional row to list GST/HST and PST as separate line items.