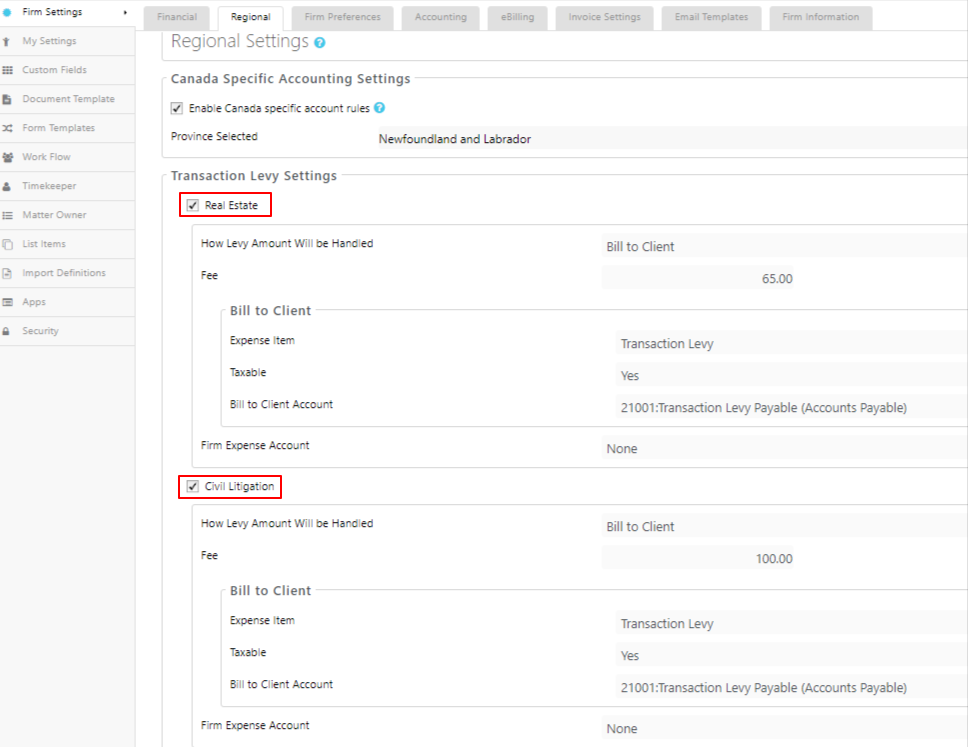

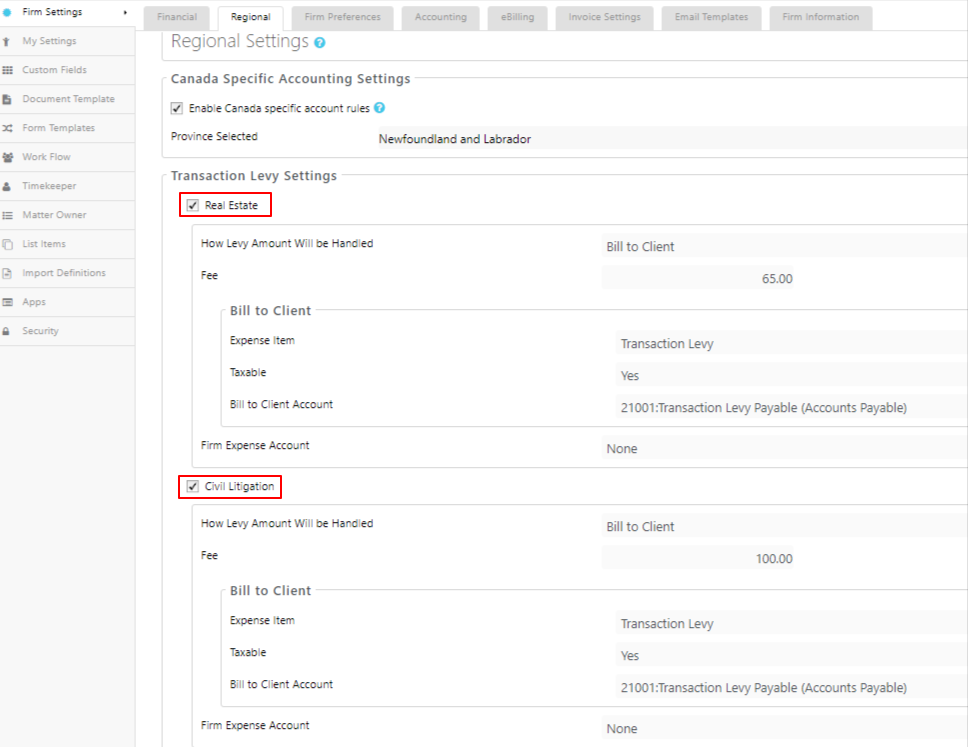

Under Setup > Firm Settings > Regional, you can review or change the default settings for handling Transaction Levies.

Note: Our Transaction Levy feature applies to firms in Ontario, Newfoundland & Labrador, and Alberta.

Levy Settings

To set up your transaction levy settings:

- Enable your province-specific settings.

- The Transaction Levy Settings appear under Regional Settings once you’ve selected the province.

- Within the Transaction Levy Settings section, the Real Estate and Civil Litigation sections’ boxes are checked by default for Ontario, Newfoundland & Labrador. Uncheck whichever may not apply.

For Alberta, Civil Litigation is the only option.

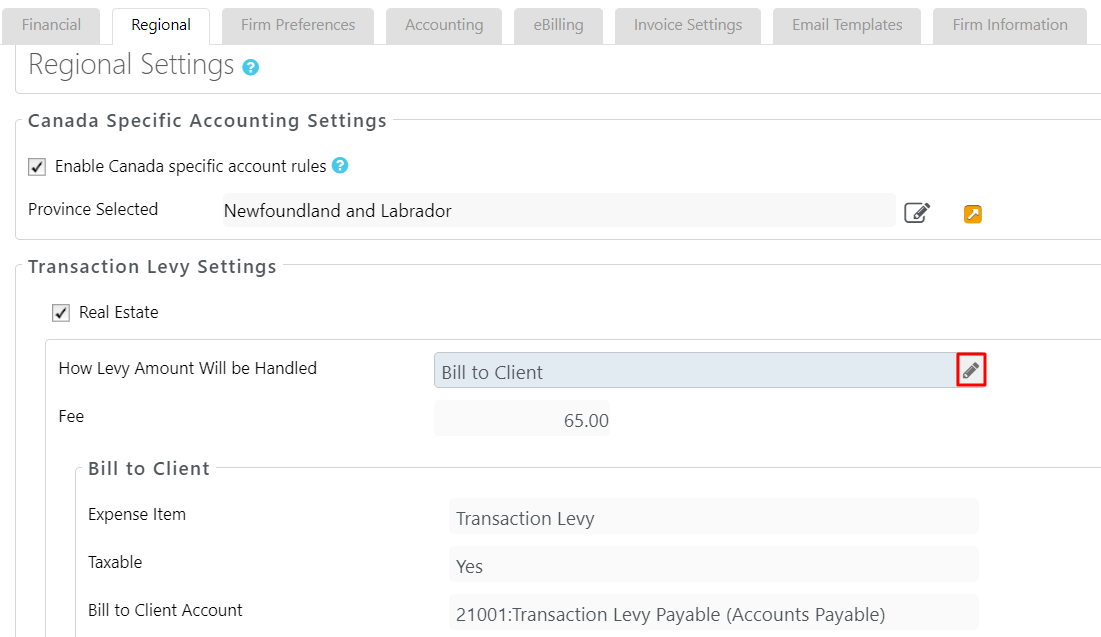

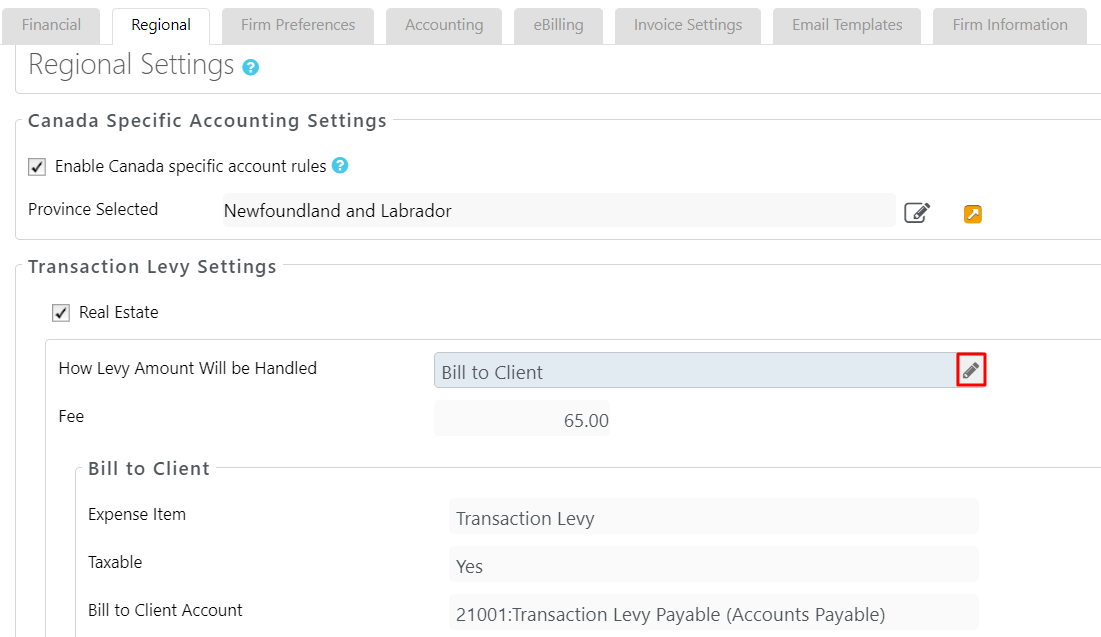

- To change a levy field setting, either click within the field or hover over the far right of the field and click the pencil icon that appears, as in this image. The field will then switch to edit mode.

- Depending on the field, you can either use the drop-down menu to click an option or enter a value. The table below provides further context for each field.

- Click the checkmark to the right of the field to save your entry or click X to cancel it.

| How Levy Amount Will be Handled |

- Default Billing setting the system will use when creating a transaction levy

- If set to Bill to Client

- The levy will automatically be set to Bill to Client when created.

- The system records the levy as a disbursement for the matter which you can include in the client’s invoice.

- If set to Firm Expense

- The levy will automatically be set to Firm Expense when created.

- The system records the levy as a business expense as if you were entering payments for items such as office supplies, rent, etc.

|

| Fee |

- Based on regional mandates and can be changed from this screen. In special cases, you can change the amount on a matter-by-matter basis when you create the Transaction Levy entry.

|

| Bill to Client |

- Default settings the system uses when creating levies that are set to Bill to Client:

- Expense Item

- This is the description that will display on the client’s invoice.

- The system sets this to Transaction Levy.

- Taxable

- This setting determines the default tax status when creating a levy

- If set to Yes, when you create a levy it is automatically marked as taxable, and will be taxed when billed to the client

- If set to No, when you create a levy it is automatically marked as non-taxable, and will NOT be taxed when billed to the client

- You can override the default on a levy-by-levy basis.

- For additional information, see HST and Insurance Premiums.

- Bill to Client Account

- The general ledger account the system will use to record levies that are billed to the client.

- Can only be assigned to 21001: Transaction Levy Payable.

|

| Firm Expense Account |

- General ledger account the system will use to record levies when Billing is set to Firm Expense.

- You can use an existing business expense account, or you can create a different expense account to use for this purpose..

|

| Report Information |

|

Learn more about our Transaction Levy Feature