Using the Transaction Levy Feature

CosmoLex’s automated transaction levy feature:

- Is available for Ontario, Newfoundland & Labrador, and Alberta provinces.

- Provides quick access reporting

- Streamlines bulk levy payment

- Prior Transaction Levy Setup required

Note: If you are located in a different province and have different Transaction Levy requirements, you will need to use Accounts Payable (AP) to manage your Transaction Levies.

Add a Levy

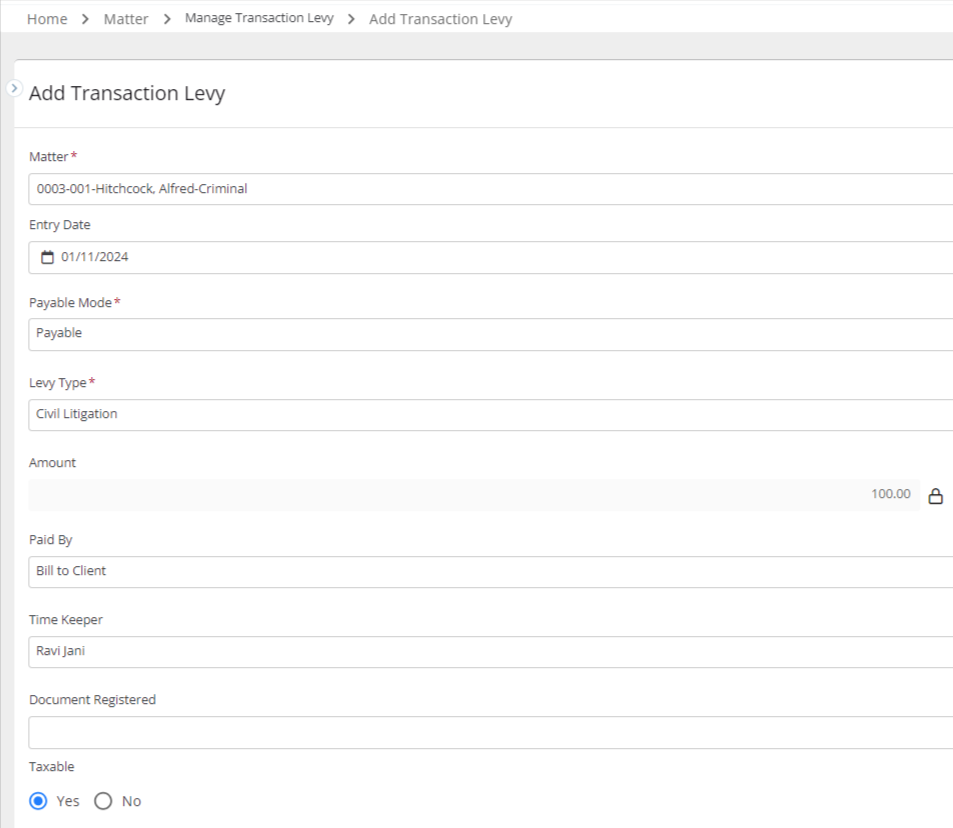

To add a transaction levy:

- From the left navigation panel, click Matters.

- Single-click the matter to highlight it.

- From the toolbar atop the screen, click Action > Transaction Levy.

- From the toolbar at the top of the Transaction Levy screen, click +Add Levy.

- On the Add Transaction Levy panel, fill in the details. You can use the drawer arrow in the top left of the panel to extend it to full screen mode.

| Matter |

|

|---|---|

| Entry Date |

|

| Payable Mode |

|

| Levy Type |

|

| Amount |

|

| Paid By |

|

| Timekeeper |

|

| Document Registered |

|

| Taxable |

|

In the top right corner, click Save.

If you chose to Bill to Client, a disbursement is automatically added to the matter which you can include on your next invoice.

Edit a Levy

Note: If the transaction levy disbursement has already been billed, you must first remove it from the invoice to edit it. Any paid levy cannot be edited.

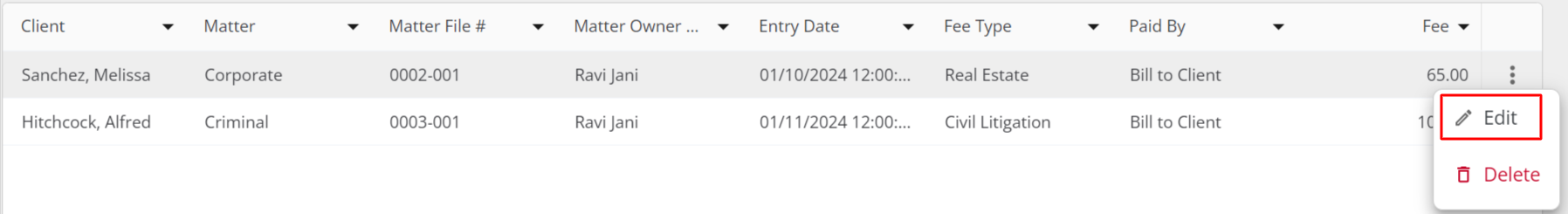

To edit a transaction levy:

- From the left navigation panel, click Matters.

- Single-click the matter to highlight it.

- From the toolbar atop the screen, click Action > Transaction Levy.

- The Manage Transaction Levy screen lists the levies for the Matter. Select the levy to which you would like to make changes by highlighting it.

- Scroll to the three dots at the end of the row and click Edit.

- The system unlocks your fields. Make the appropriate changes.

- In the top right corner, click Save.

Remove a Levy

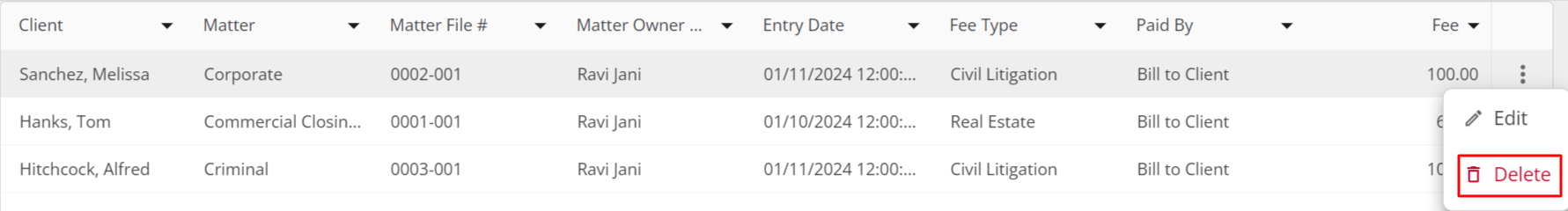

To remove a levy and its associated disbursement:

- From the left navigation panel, click Matters.

- From the Matters screen, single-click the matter to highlight it.

- From the toolbar atop the screen, click Action > Transaction Levy.

- The Manage Transaction Levy screen lists the levies for the Matter. Select the levy which you would like to remove by highlighting it.

- Scroll to the three dots at the end of the row and click Edit.

The Delete Transaction Levy message box reads: Are you sure you want to delete this transaction levy? - Click Delete.

The Transaction Levy message box reads: The levy associated with this matter has been successfully removed.