Manage Your 1099-Eligible Payees

You can flag payees that qualify as 1099-eligible and produce reports to monitor your firm’s payments to those payees.

Tag a Payee as 1099-Eligible

To tag a payee as 1099-eligible:

- Edit the payee you want to flag.

- Confirm the Tax ID is accurate.

- Under the Contact Info section, confirm the address is accurate.

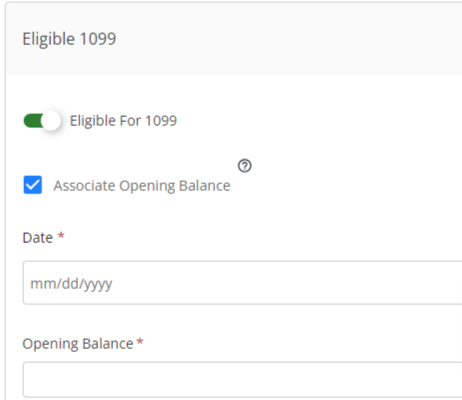

- Toggle on the 1099 Eligible button.

- If your payee has an opening balance that has been tracked externally to Cosmolex, check the box beside Associate Opening Balance.

Note: You can use this option to define this balance and be considered for reporting options. - Enter the date and amount of the opening balance.

Note: This amount will be included in the 1099 Payee Ledger Report.

- In the upper right corner, click Save.

The system saves your payee flag and displays it on the Payee screen. You can use search filters to identify these payees.

Generate a 1099 Payee Ledger for Filing

To generate a 1099 Payee Ledger for filing:

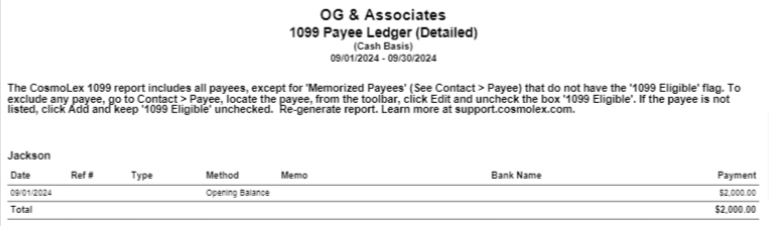

- Generate a 1099 Payee Ledger Report.

- The 1099 report includes all payees except those for whom you did not check the 1099 Eligible box. To exclude any payee, edit the payee and uncheck the 1099 Eligible box. If the payee is not listed, add the payee and keep 1099 Eligible unchecked.

- Re-generate the report, if needed.