Manage Bank Errors

You can record bank errors during the reconciliation process to avoid having to allocate the errors to a client or firm ledger.

Step 1: Allow Bank Error Tracking During Reconciliation

To allow bank error tracking during the reconciliation process:

- Add or edit a bank account.

- Under the Advanced Settings section, check the box to Allow bank error tracking during reconciliation.

- Click Save.

The system activates bank error tracking during reconciliation.

Step 2: Add a Bank Error

To add a bank error:

- Reconcile your bank account.

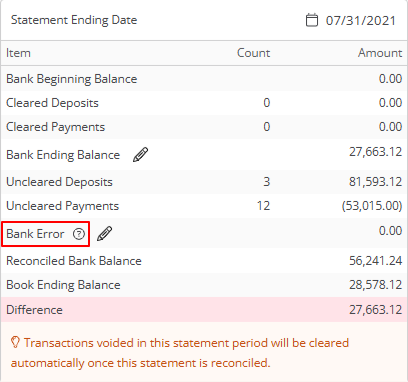

- During the reconciliation process and in the summary panel, the Bank Error field lists pending errors from the previous statement and those added for the current statement.

Caution: The Bank Error feature is meant to record genuine bank errors.

To resolve firm-related data entry issues, edit the original transaction. Improper use of the Bank Error feature to force a reconciliation statement to balance, can result in serious ethics and compliance issues.

- Click on the pencil icon.

The Bank Error Details screen opens. The Bank and Account fields auto-populate. - From the toolbar, click Add.

- On the Add Bank Error screen, from the Date field’s drop-down, click the incorrect bank transaction’s date.

- From the Type field’s drop-down, click Debit or Credit as applicable.

- In the Amount field, enter the original transaction amount.

- In the Description field, enter a description for easy future reference.

- In the upper right corner, click Save.

The Add Bank Error screen closes, returning you to the Bank Error Details screen. - In the upper left corner, click Reconciliation Details.

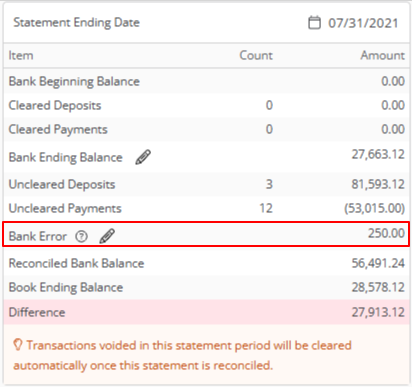

The Bank Error Details screen closes, returning you to the Reconciliation screen. The Bank Error field displays the bank error total.

- When the bank corrects their error, follow this same process to enter the bank’s correction and zero out the corresponding errors.

The second entry offsets the first and allows you to reconcile the statement.Once you have added an entry, you can select it, click on the three dots at the end of the row and from the drop-down, click Edit or Delete as desired.

Edit a Bank Error

To edit a bank error:

- If your firm has reconciled the statement containing the bank error, you must first re-open it.

- Open the reconciliation statement.

- Beside the panel’s Bank Error field, click the pencil icon.

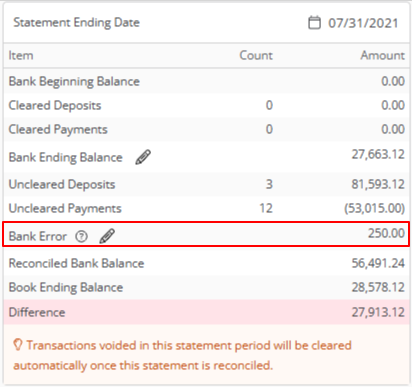

- The Bank Error Details screen opens. The Bank and Account fields auto-populate.

- Single-click the error, click on the three dots at the end of the row and from the drop-down, click Edit.

- On the Edit Bank Error screen, make your changes.

- In the upper right corner, click Save.

The Add Bank Error screen closes, returning you to the Bank Error Details screen. - In the upper left corner, click Reconciliation Details.

The Bank Error Details screen closes, returning you to the Reconciliation screen.

Delete a Bank Error

To delete a bank error:

- If your firm has reconciled the statement containing the bank error, you must first re-open it.

- Open the reconciliation statement.

- Beside the panel’s Bank Error field, click the pencil icon.

Caution:

The Bank Error feature is meant to record genuine bank errors.

To resolve firm-related data entry issues, edit the original transaction. Improper use of the Bank Error feature to force a reconciliation statement to balance can result in serious ethics and compliance issues. - The Bank Error Details screen opens. The Bank and Account fields auto-populate.

- Single-click the error, click on the three dots at the end of the row and from the drop-down, click Delete.

The Delete Bank Error message reads: Are you sure you want to delete selected item? - Click Delete.

The system deletes the bank error. - In the upper left corner, click Reconciliation Details.

The Bank Error Details screen closes, returning you to the Reconciliation screen.

Important to Know

- You can only manage bank errors within an open reconciliation statement.

- You must reopen a reconciled statement to manage bank errors within it.

- Neither the Reconciliation Report nor the Three Way Reconciliation Report display bank errors as a line item.