Profit and Loss Report

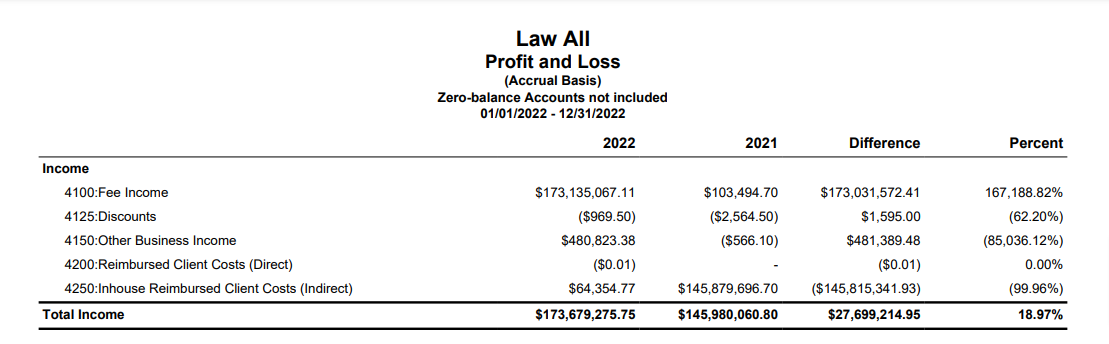

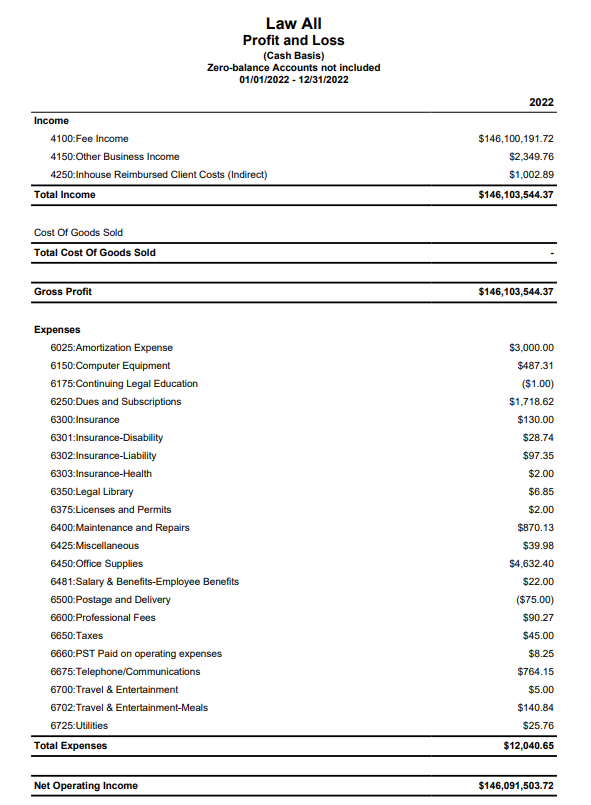

The Profit and Loss Report report summarizes the revenues, costs, and expenses incurred during a specific period of time – usually a fiscal quarter or year. These records provide information that shows the ability of a company to generate profit by increasing revenue and reducing costs.

To access this report, go to Reports > Accounting > Profit & Loss

Report Filters

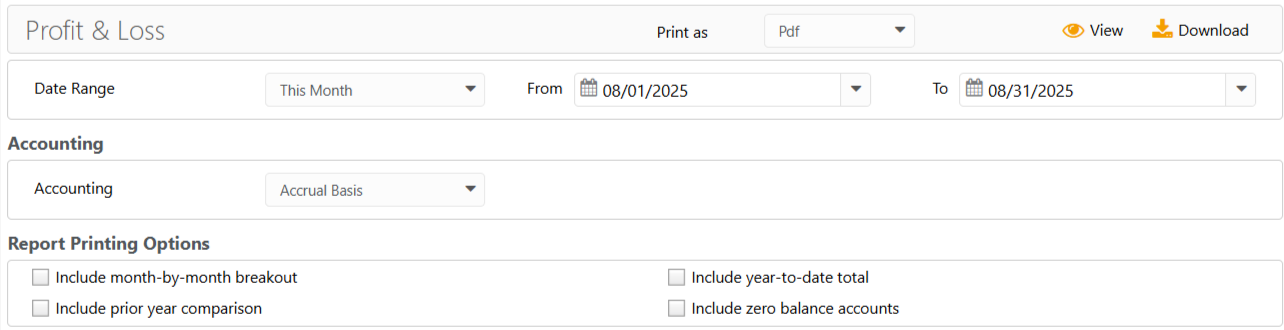

- Date Range: The date range options you have are All Dates, Last Month, Last Year, This Month, and This Year. You can override the date range via the from/to boxes to the right

- Accounting: You can generate the Profit and loss Report for two types of accounting: cash basis or accrual basis.

Report Printing Options

- Include month-by-month breakout: Checking this option will allow you to download month-by month breakout of the report in Excel format with allocations broken down by month for the full year.

- Include year-to-date total: Checking this option will show the year-to-date total. The two columns on the report show allocations for the selected period, and cumulative Year-to-Date totals.

- Include prior year comparison: Checking this option will show amounts from the prior year as well as dollar and percentage differences. This is unchecked by default.

- Include zero balance accounts: Checking this option will include those income and expense accounts which have 0.00 balances. This is unchecked by default

View/Download

Click View to preview the report or to download, select the preferred format (Excel/pdf) and click Download.