Disbursement Incurred as Agent (Canada)

“Disbursement incurred as agent” refers to a matter-related expense (hard cost) where the entire expense, inclusive of taxes, merely passes through the firm’s books. This means that the firm doesn’t claim an input tax credit (ITC) for the taxes paid to the vendor, and the firm doesn’t charge taxes when it invoices the hard cost to the client.

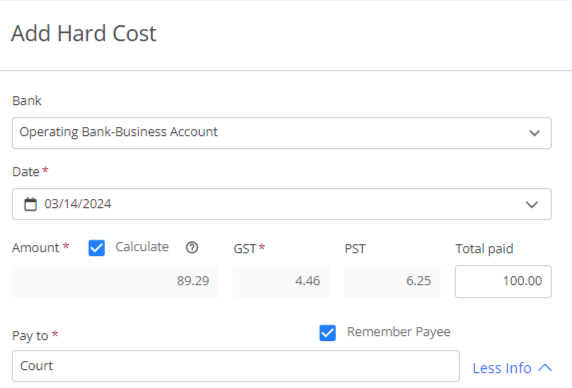

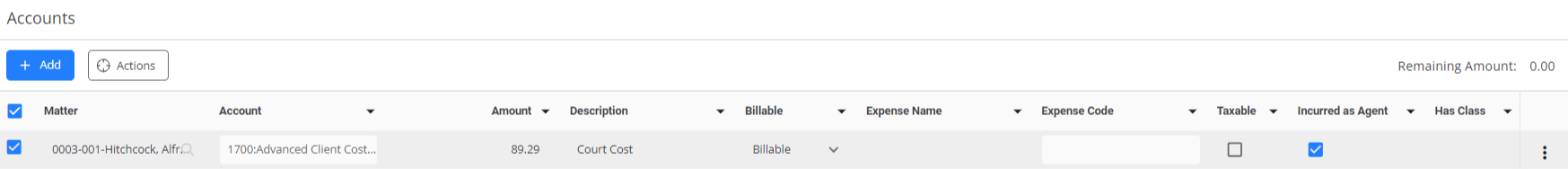

In the screenshot below, the firm needs to pay a vendor the amount of $100.00, If the GST on the amount is $4.46 and PST is $ 6.25 and the firm wishes to not include the $10.71 in their ITC, they have checked “Disbursement incurred as agent” in the Accounts section and completed the expense as usual.

When completing a hard cost, there are two ways to enter the tax you wish to pass through. Each impacting your billing records differently.

- Enter tax amounts in the GST/HST or QST/PST field(s) (e.g. 10.71)

- Enter the total, inclusive of taxes in the amount field (e.g. 110.71)

Impact on Invoicing

If using GST/HST or QST/PST fields:

- The “Amount” of the expense, exclusive of taxes, appears in the list of hard costs.

- The GST/HST for the expense is added to the cost GST/HST line item.

- The QST/PST for the expense is added to the cost QST/PST line item.

- To show the cost taxes separately from the taxes on expenses that were disbursed as an agent, use the fields found here.

If including tax in the Amount field

- The entire vendor invoice amount appears in the list of hard costs.

- The invoice will not indicate how much of the total amount was GST/HST or QST/PST. (If the client requests this breakdown, the firm will have to send the vendor invoice separately)

Impact on the General Ledger

- Taxes recorded in the GST/HST or QST/PST fields on the matter-related expense are recorded in the 1701 and 1702 GL Advanced Client Costs (Disbursement WIP) accounts prior to billing.

- Upon billing the WIP is moved out of 1701 and 1702 and recorded in the 1200 AR GL.

- When the hard cost is invoiced to the client, taxes are not charged, so, there are no entries made to the 2201 GST/HST Collected or the 2210 QST/PST Collected GL accounts.